Medicare Part A, B, C, and D: What You Need to Know

Medicare Parts A, B, C, and D are the four distinct types of coverage available to eligible individuals. Each Medicare part covers different healthcare-related costs. While Medicare Part A and Medicare Part B are administered by the Centers for Medicare and Medicaid Services (CMS), Medicare Part C and Medicare Part D are managed by private insurance companies.

Medicare is similar to the health insurance coverage you’ve probably had with an employer or an individual policy. It can cover doctor visits, inpatient and outpatient hospital care, prescription drugs, and lab tests. Depending on the plan you choose, your Medicare plan can also cover dental and vision, if you like.

Here’s a brief overview of each of the parts of Medicare.

What Is Medicare Part A?

Medicare Part A (also known as hospital insurance) is a basic insurance plan that covers medical services related to inpatient hospitalization and skilled nursing care. It is offered at low or no cost to Americans who are 65 years old and have contributed toward Social Security, as well as other qualified individuals.

What Medicare Part A Covers:

- Inpatient care in a hospital

- Skilled nursing facility care

- Inpatient care in a skilled nursing facility

- Hospice care

- Home health care

How Much Does Medicare Part A Cost?

If you or your spouse have worked at least 10 years in any job where you paid Social Security taxes, you do not have to pay a premium for Part A.

- Premium: $0 per month

- 2023 deductible: $1,600 for each benefit period

The 2023 Medicare Part A premium for those who do not qualify for $0 premiums is either $278 or $506 per month, depending on how long you worked and paid Medicare taxes.

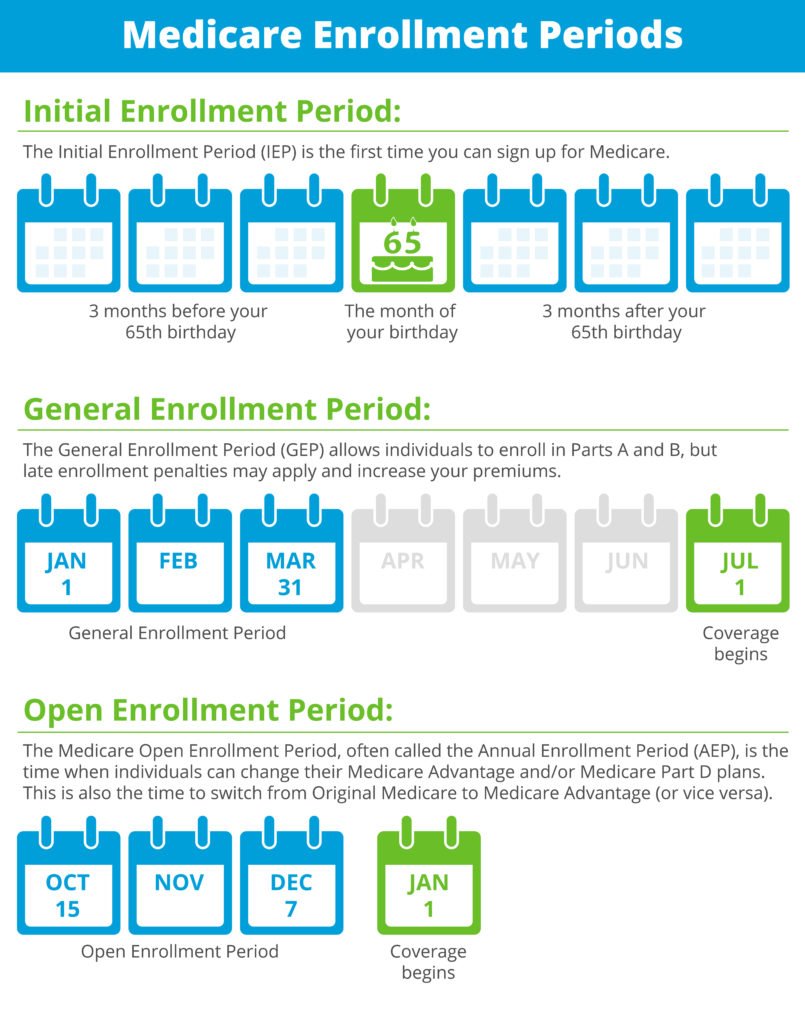

Enrollment Period for Medicare Part A

You’re eligible to enroll in Medicare Part A during your Initial Enrollment Period (IEP), which is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes your birth month, and lasts up to three months after your birthday month.

When you apply for Social Security benefits, you’re automatically enrolled in Medicare Part A.

What Is Medicare Part B?

Medicare Part B (also known as medical insurance) is an insurance plan that covers medical services related to outpatient and doctor care. Part B covers medically necessary care and treatment, including:

- Medically necessary services or supplies

- Preventive services

- Clinical research

- Ambulance services

- Durable medical equipment

- Mental health services

- Getting a second opinion before surgery

- Limited outpatient medications

How Much Does Medicare Part B Cost?

The standard costs for Medicare Part B in 2023 are:

- Premium: $164.90 per month (or higher depending on your income)

- Deductible: $226

- Coinsurance: 20%

Enrollment Period for Medicare Part B

You’re eligible to enroll in Medicare Part B during the seven-month period around your 65th birthday—beginning three months before the month of your 65th birthday, including your birthday month, and lasting up to three months after. This is called your Initial Enrollment Period (IEP). Enrollment in Part B is automatic if you are receiving Social Security or Railroad Retirement Board benefits.

What Is Medicare Part C?

Medicare Part C, also called Medicare Advantage, includes the coverage benefits of Medicare Parts A and B. Medicare Part C plans can also offer prescription drug benefits and other additional coverage (like vision and dental). In total, Medicare Part C can cover things like:

- Medicare Part A (hospital insurance)

- Medicare Part B (medical insurance)

- Medicare Part D (prescription drugs)

- Vision

- Hearing

- Dental

- Health and wellness programs

How Much Does Medicare Part C Cost?

The estimated average 2023 Medicare Part C premium is $18 per month. Many Medicare Part C beneficiaries do not pay a premium for their plan – other than the Medicare Part B premium. Costs may vary significantly between plans.

Enrollment Period for Medicare Part C

You are eligible to enroll in Medicare Part C during your Initial Enrollment Period (IEP). This is the seven-month period around your 65th birthday. Your IEP begins three months before the month of your 65th birthday, includes the month of your birthday, and lasts up to three months after the end of your birthday month.

Enrollment is optional and not automatic. You must first have Medicare Parts A and B, and then you can sign up for Medicare Part C with a private insurance company. With this plan, you make payments directly to your insurance provider.

What Is Medicare Part D?

Medicare Part D offers coverage for prescription drugs. The prescriptions covered depend on the plan you select; they can be found in your plan’s drug formulary.

How Much Does Medicare Part D Cost?

The estimated average 2023 premium for Medicare Part D is $31.50 per month. The deductible ranges from $0 to $505.

Enrollment Period for Medicare Part D

Like Medicare Part C, you are eligible to enroll in Medicare Part D during the seven-month period around your 65th birthday—beginning three months before the month of your 65th birthday, including the month of your birthday, and up to three months after the end of your birthday month. You must enroll directly through an insurance company.

When Can I Enroll in Medicare Part A, B, C, and D?

Which Medicare Part Is Right for Me: Medicare Part A, B, C, or D?

Which Medicare part(s) you choose depends on what medical services you want covered. Here’s a quick recap of what’s covered under Parts A, B, C, and D:

| Part A | Part B | Part C (Medicare Advantage) |

Part D |

|---|---|---|---|

| Hospital Insurance: Inpatient hospital visits Skilled nursing care Home health care Hospice care |

Medical Insurance: Doctor visits Outpatient care Lab tests Ambulance services Some medical equipment |

Hospital Insurance Medical Insurance Prescription Drugs (not all plans) Vision (not all plans) Dental (not all plans) |

Prescription Drugs |

Discover Which Medicare Part May Be Right for Your Needs

To help you decide how to choose what type of Medicare coverage is right for you, review your needs every year. Ask yourself basic questions such as:

- How much can I afford in out-of-pocket expenses?

- Do I want to keep my current providers?

- What prescriptions do I have?

- Do I need coverage for when I travel?

- Which hospitals or doctors are closest to me?

Get started reviewing your options online today or call (800) 827-9990 to speak with a licensed insurance agent.